st louis county sales tax 2020

Monday - Friday 8 AM - 5 PM. Sales Dates for 2022 Sale 208.

County Sales Tax information registration support.

. The 2018 United States Supreme Court decision in South Dakota v. 2020 rates included for use while preparing your income tax deduction. Louis County Public Safety Sales Tax Quarterly Report 2020 Quarter 4 Beginning Balance 1012020 Restated 19560084 Revenue Received 11839779 Expenditures Family Court Initiatives 124184 Family Court Pay Program 2020 321341.

May 10 2022 and May 17 2022. 2020 rates included for use while preparing your income tax deduction. What is the sales tax rate in St Louis County.

Online auction continues July 27 through August 24 2022 at 1100 am. Rate lookup is free for all 50 states Puerto Rico and Washington DC. Louis County local sales taxesThe local sales tax consists of a 214 county sales tax and a 125 special district sales tax used to fund transportation districts local attractions etc.

4 beds 35 baths 1920 sq. This rate includes any state county city and local sales taxes. What is the sales tax rate in St Louis County.

The December 2020 total local sales tax rate was. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. Subtract these values if any from the sale.

This is the total of state and county sales tax rates. This file is second of three data sets used to produced the Change of AssessmentProject Tax Liability Notices for residential parcels. Louis County Public Safety Sales Tax Quarterly Report Restated 2020 Quarter 3 Beginning Balance 07012020 21614616 Revenue Received 12214364 Expenditures Family Court Initiatives 110149 Family Court Pay Program 2020 321341.

Louis County does not charge sales tax on tax-forfeited land sales. The Missouri state sales tax rate is currently 423. Integrate Vertex seamlessly to the systems you already use.

Ad New State Sales Tax Registration. Louis County Missouri Tax Rates 2020. The St Louis County sales tax rate is 226.

There is no applicable county tax or special tax. Missouri has a 4225 sales tax and St Louis County collects an additional 2263 so the minimum sales tax rate in St Louis County is 6488 not including any city or special district taxes. Minnesota has a 6875 sales tax and St Louis County collects an additional NA so the minimum sales tax rate in St Louis County is 6875 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in St.

Public Safety Sales Tax Quarterly Report 2020 Quarter 2 Beginning Balance 04012020 22680774. The latest sales tax rate for Saint Louis MO. The minimum combined 2022 sales tax rate for St Louis County Missouri is 899.

Louis County Sales Tax is collected by the merchant on all qualifying sales made. NO LAND TAX SALE MAY 26 2022. Division of Performance Management Budget 07022020.

This rate includes any state county city and local sales taxes. April 5 2022 and April 12 2022. Land Tax sales this year are held 5 times a year in April May June July and August.

St louis county sales tax 2021. Louis County Missouri Tax Rates 2020. The total sales tax rate in any given location can be broken down into state county city and special district rates.

NO LAND TAX SALE MAY 26 2022. The December 2020 total local sales tax rate was 7613. ALL PROPERTIES HAVE BEEN SOLD.

4132020 120651 PM. Ad Automate Standardize Taxability on Sales and Purchase Transactions. Continuous Online Auction Book.

Auctions may extend if bids are placed within 5 minutes of closing. The St Louis County sales tax rate is. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax.

Louis County Land Sales. Sales are held on the 4th floor of the Civil Courts Building at 10 N Tucker Blvd. Below is the list of counties that will not participate in the 2022 sales tax holiday.

Louis County Division of Performance Management Budget 04132020. The 2018 United States Supreme Court decision in South Dakota v. The 9679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax and 5454 Saint Louis tax.

722020 113001 AM. Prop P Quarterly Reportxlsx Author. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Prop P Quarterly Reportxlsx Author. Land Tax sales are held 5 times in 2022. Saint Louis MO Sales Tax Rate.

ALL PROPERTIES HAVE BEEN SOLD. April 19 2022 Published Dates. This is the total of state and county sales tax rates.

What Is The. You pay tax on the sale price of the unit less any trade-in or rebate. Louis which may refer to a local government division.

Continuous Online Land Sale Auction. Ad Download tax rate tables by state or find rates for individual addresses. The sales tax jurisdiction name is St.

The latest sales tax rate for Saint Louis County MO. This table shows the total sales tax rates for all cities and towns in St. For tax rates in other cities see Missouri.

4024 Enright Ave St Louis MO 63108 499900 MLS 22043684 Something special this way comes nothing borrowed everything new. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. The Minnesota state sales tax rate is currently.

Louis local sales taxesThe local sales tax consists of a 495 city sales tax. Public Safety Sales Tax Quarterly Report 2020 Quarter 1 Beginning Balance 01012020 17551454. The minimum combined 2022 sales tax rate for St Louis County Minnesota is.

County sales tax in these locations will still be collected on the sale of qualifying holiday. 41 South Central Avenue Clayton MO 63105. You can print a 9679 sales tax table here.

The combined rate used in this calculator 9238 is the result of the missouri state rate 4225 the 63119s county rate 2263 the saint louis tax rate 15 and in some case special rate 125. The current total local sales tax rate in Saint Louis MO is 9679.

Council Rules St Louis County Website

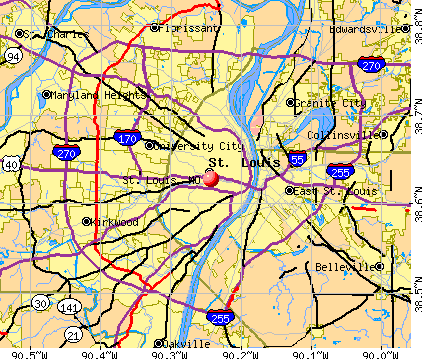

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Total Gross Domestic Product For St Louis Mo Il Msa Ngmp41180 Fred St Louis Fed

Print Tax Receipts St Louis County Website

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

![]()

Performance Management And Budget St Louis County Website

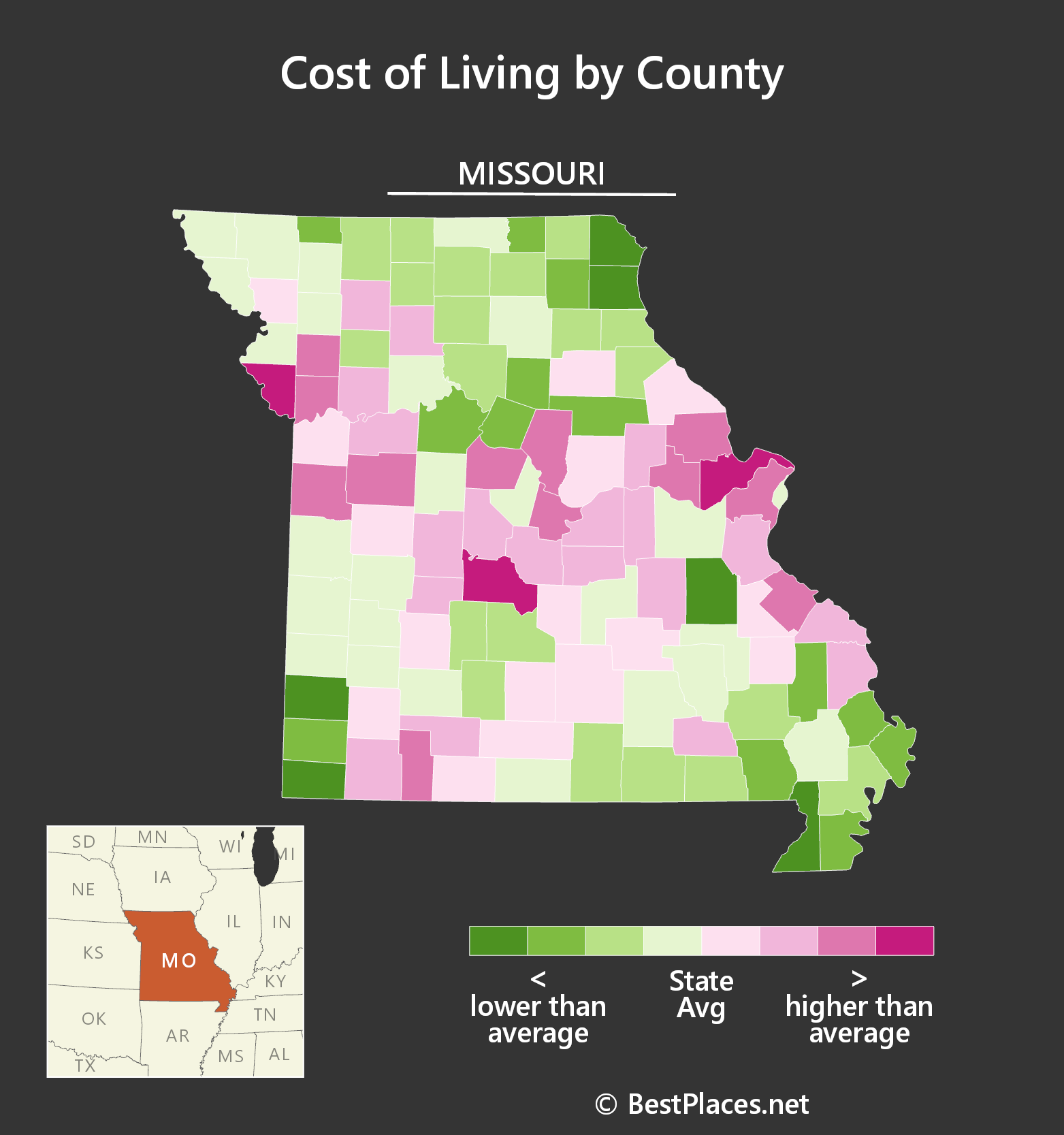

Best Places To Live In St Louis Missouri

Collector Of Revenue St Louis County Website

New Subaru Dealer Near St Louis New Ascent Outback Crosstrek Legacy Forester Impreza Wrx Cars For Sale Sunset Hills Subaru Serving Metro East

Revenue St Louis County Website

Online Payments And Forms St Louis County Website

Best Places To Live In Lake St Louis Missouri

St Louis Missouri Is Rebounding From A Long Decline By Focusing On Its Historic Heritage

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

What S Living In St Louis Mo Like Moving To St Louis Ultimate Guide

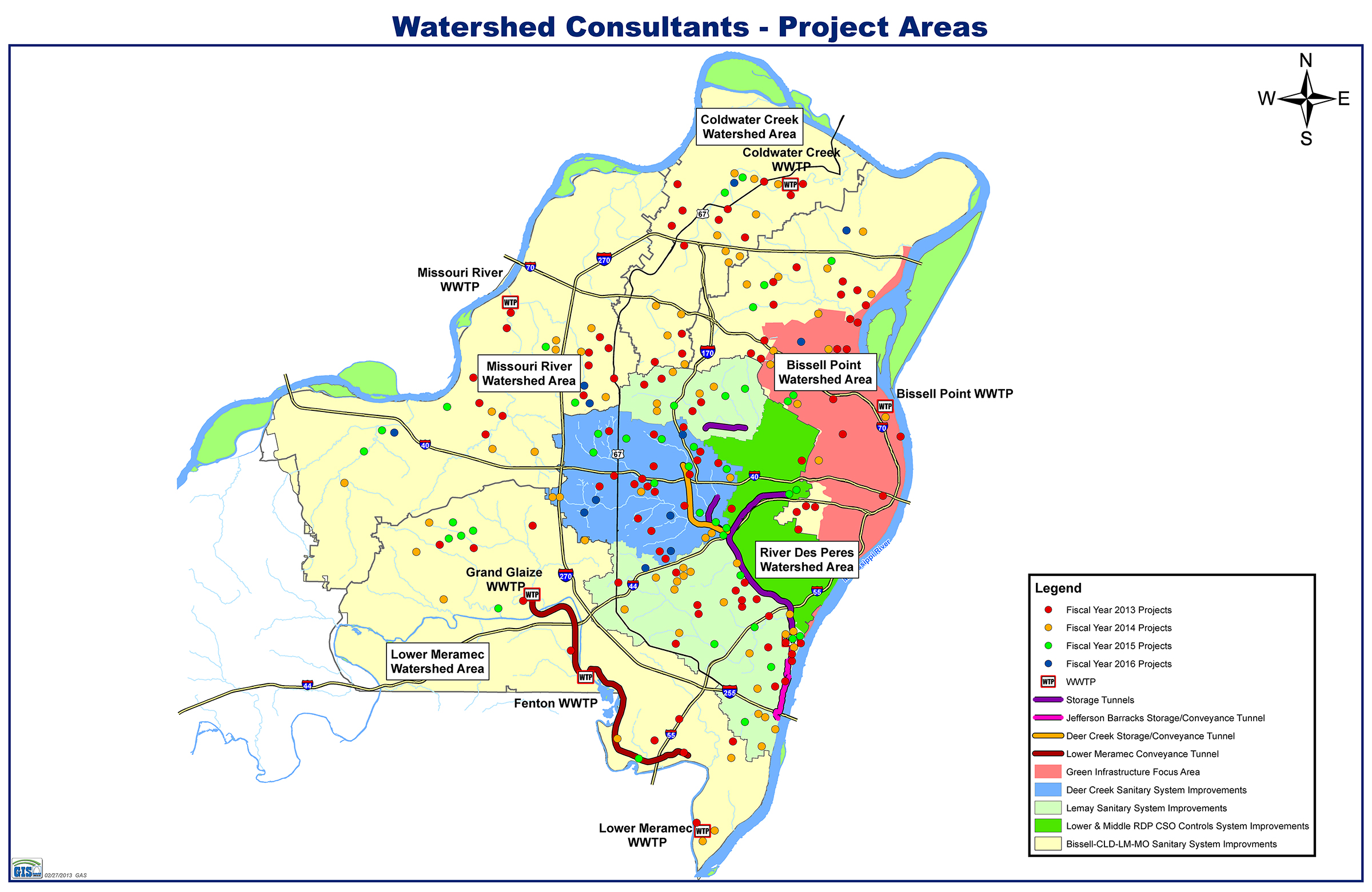

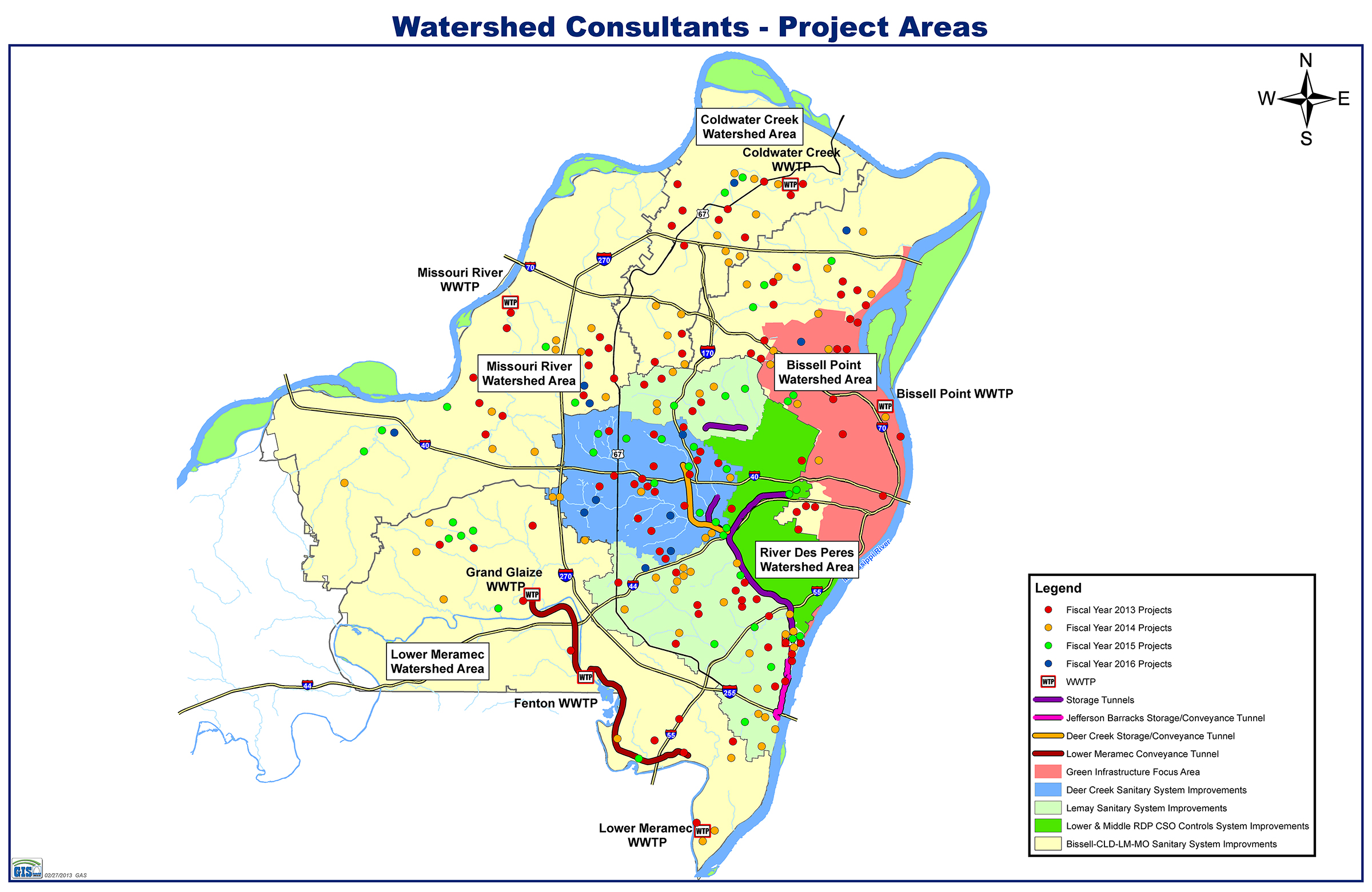

Watershed Map Information Metropolitan St Louis Sewer District